By: gconsulting05 / September 29, 2024

By: gconsulting05 / September 29, 2024

Introduction:

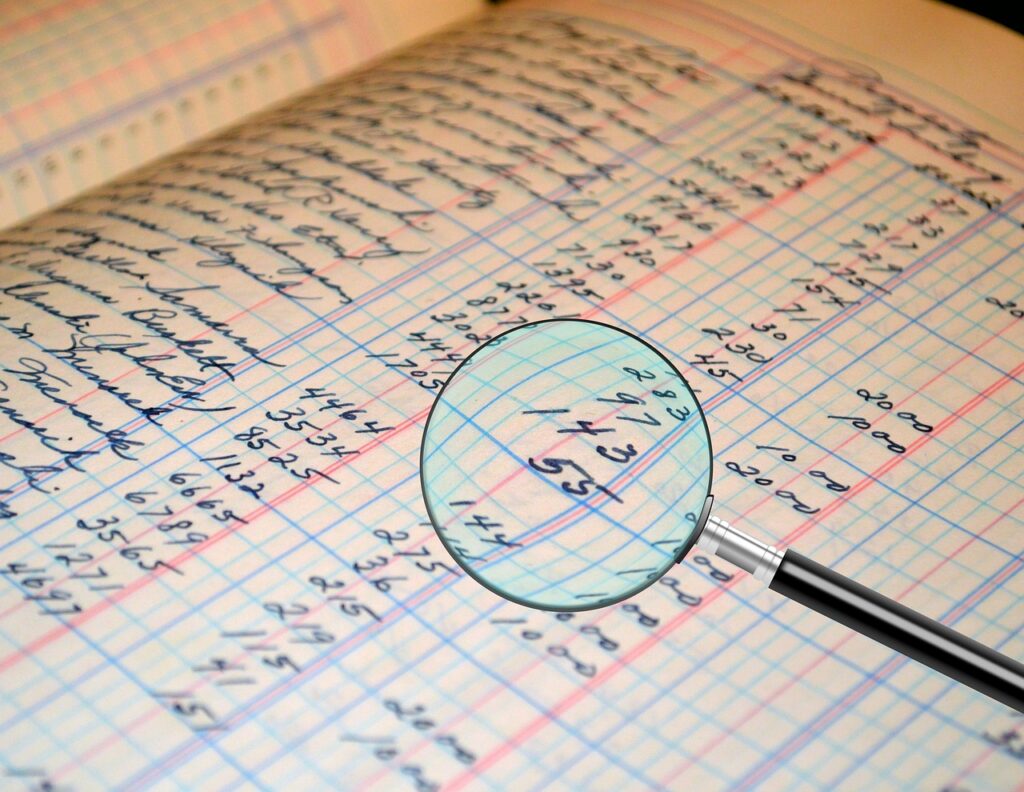

A financial audit can be a daunting task for any business, but with the right preparation, it becomes a valuable opportunity to improve financial accuracy and business efficiency. At Global Auditing and Consulting LLC, we guide businesses through the audit process to ensure transparency and compliance. Here are five essential steps to ensure a successful financial audit.

1. Organize Your Financial Records

The first step in preparing for a financial audit is to ensure that all financial records are up-to-date and properly organized. This includes income statements, balance sheets, and cash flow statements. A well-organized financial report not only speeds up the audit process but also reduces the chance of errors or inconsistencies.

Tip: Use cloud-based accounting systems to centralize and track your financial data in real time.

2. Conduct an Internal Review

Before the auditors arrive, it’s important to conduct an internal review. This will help you identify and address any discrepancies in your records, ensuring they align with your financial statements. An internal review is a proactive step that allows you to correct mistakes and reduce audit risks.

Tip: Assign a team member to regularly review financial reports for accuracy and consistency.

3. Understand Compliance Requirements

Every industry has its own regulatory and compliance requirements. Knowing what’s expected of your business helps ensure that the audit runs smoothly. Whether it’s industry-specific regulations or general accounting standards, staying informed on compliance is key to avoiding issues during the audit process.

Tip: Work with your financial advisors to stay current on any changes to financial regulations.

4. Communicate with Your Audit Team

Open and clear communication with your auditors is essential for a smooth audit process. Set expectations early and ensure that your team is available to provide necessary documentation or answer any questions during the audit.

Tip: Schedule a pre-audit meeting with your auditors to go over the scope, timeline, and any potential challenges.

5. Use the Audit as a Learning Tool

Once the audit is complete, use the findings to improve your business operations. Audits often uncover areas where processes can be optimized or internal controls strengthened. Instead of viewing the audit as a compliance requirement, treat it as an opportunity to gain valuable insights into your financial health.

Tip: Review the audit report with your team and implement recommended changes to improve efficiency and reduce risks in the future.

Conclusion:

A well-prepared audit is not only about compliance but also about enhancing your business’s financial integrity. At Global Auditing and Consulting LLC, we help businesses navigate the audit process with confidence, ensuring that you can focus on growth and success. If you’re ready to get started with your financial audit, contact us today for expert guidance.

Leave a Comment